Recently, the social security trustees offered yet another stark reminder that America is nearing an entitlement crisis. Within a decade, the Medicare hospital trust fund will be insolvent; within two decades, social security will be. When that happens, each program will be forced to automatically cut benefits—in the case of social security by over 20%. To fully fund the shortfall for the next 75 years, we would need to immediately inject about $17.5 trillion into the two programs, $3.5 trillion into Medicare and $14 trillion into Social Security, a financial impossibility.

Over time, it is a financial necessity to make some changes to the programs, like a gradual increase in the retirement age, to improve their financial situation and ensure they will be there for future generations. Donald Trump promised to govern on behalf of the forgotten men and women of the working class who in particular rely on these programs in their sunset years, which is why it is critical he takes steps to sure up their finances.

Now, not only is it financially impossible to fully fund these programs for perpetuity today, it is unnecessary. The $17.5 trillion shortfall is a best-efforts estimate that can shift materially if for instance economic growth is faster than forecast, which would result in higher tax revenue. Nonetheless, Social Security and Medicare clearly face shortfalls, and we should find ways to extend the trust funds’ lives. Fortunately, there actually is a way to materially extend these programs’ lives, reduce today’s budget deficit, make mortgage rates lower, and not reduce benefits by a dollar.

The United States Treasury should sell $2 trillion in zero coupon, putable, perpetual bonds (more on their structure below) to the Federal Reserve, America’s central bank. In turn, about $600 billion would be granted to the Medicare hospital trust fund and $1.4 trillion to Social Security’s trust fund. With these additional sums, Medicare would be able to meet current benefits into the mid-2030s, about a 10 year improvement, and Social Security into the mid-2040s, about a 5 year improvement. This step would provide more security and certainty to older Americans and give us more time to make gradual changes to the programs for future beneficiaries to further extend their solvency.

Now as is the case with existing trust fund sums, this $2 trillion would be invested over time in US treasury debt. With the budget deficit likely to surpass $800 billion annually in coming years, the trust funds’ buying power would essentially cancel out 2-2.5 years of new budget deficits. By buying US debt, we would be selling fewer treasuries to private investors, this reduced supply would mean we can sell our debt at a higher price, all else equal. In other words, we would sell debt at a lower interest rate. Paying less in interest would bring down the US budget deficit somewhat. Additionally, US treasury interest rates are the benchmark off of which most banks determine their mortgage rates, business loan interest rates, and so forth. So, a lower treasury rate will translate to lower mortgage rates, making home buying more affordable.

To some, this may sound too good to be true. If we are putting more money into entitlement programs, and bringing down the cost of debt in the process, there must be a catch, and they would point to the $2 trillion in bonds the government would sell to the Federal Reserve. Note though that the bonds sold to the Fed are “zero coupon,” which means they pay no interest, meanwhile the trust funds would be using the proceeds to buy US treasury debt that does pay interest. Additionally, these zero-coupon bonds are “perpetual,” meaning they never have to be paid back. In reality, these Fed-owned bonds hold no economic value. However, the Fed would “print” $2 trillion to send to Medicare and Social Security in exchange for them. At this point, some may say I am merely proposing printing money to pay for entitlements, which will cause inflation and weaken the dollar. As I will explain, that is actually not what I am proposing, but first, let me rebut the case that printing money in the first place would definitely be inflationary.

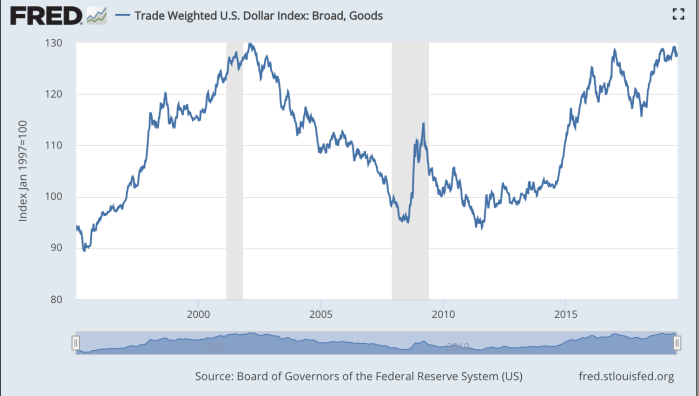

Over the past ten years, the Federal Reserve has printed about $3.4 trillion buying treasury and mortgage bonds, nearly quintupling its balance sheet to $4.3 trillion. During this time, the US dollar has actually strengthened by over 26% on a trade-weighted basis and core inflation has averaged less than 1.6%, below the Fed’s target of 2%. The many predictions that Fed policy would create runaway inflation simply have not come true.

Moreover, it is worth noting that the fashion in which the Federal Reserve operates its monetary policy has exacerbated income inequality and the stagnation of median incomes for the past two decades. Targeting 2% inflation, the Fed tends to raise interest rates as we near full employment. Now, it is during periods of at or near full employment where workers are more in demand than in supply, meaning they enjoy the greatest wage increase. Immediately after a recession, even as business improves, there are many people eager for work, so businesses don’t have to increase wages even as the business grows, leading to higher profit margins. Periods of full employment reverse this with workers getting a bigger share of the pie. However in its fear of inflation, the Fed raises rates as the labor market improves, truncating the time spent in a tight labor market relative to the time in a loose labor market.

As this continues over each economic cycle, business owners get a gradually increasing piece of the economic pie at the expense of workers, widening inequality and leaving our middle class behind. In fact, over the past twenty years, core inflation has averaged 1.7%, missing the Fed’s 2% target and showing its preference for low-inflation periods when businesses have the bargaining power to tight labor market periods when workers do. Using the Fed balance sheet to support entitlement programs that particularly benefit middle and working class Americans would help counteract this bias.

Now to those still unsatisfied by my argument that using the Fed to create money is not problematic, I wish to explain why I am not proposing printing money. Rather than have the Fed print $2 trillion, I recommend selling $2 trillion in zero coupon, putable, perpetual bonds. True, zero coupon perpetual bonds have no economic value, but note the word “putable.” Putable means the Fed can “put back” (sell) the bonds at face value to the treasury if certain conditions are met. Namely, in any month when the core PCE index (the Fed’s preferred inflation measure) rises by 3-3.5% year over year, $50 billion of bonds are put back, 3.5-4% $75 billion, 4-4.5% $100 billion, 4.5-5% $125 billion, and over 5% $150 billion.

Essentially if I am wrong, and this program causes inflation to rise materially above the Fed’s 2% target, the Fed would be able to sell the bonds back, taking the US dollars back out of circulation, thereby tightening policy to bring inflation back down. Given that inflation hasn’t passed 3% on an annual basis in 26 years, it is likely that little if any of this $2 trillion bond is ever put back to the treasury. And if such a period comes sufficiently in the future, the amount saved on interest payments thanks to Social Security and Medicare buying treasury debt may well exceed the cost of buying back these putable bonds. I would venture a prediction that this $2 trillion bond issuance does not lead inflation to breach the putable levels over the forecastable horizon.

Given the structural undershoot of inflation, a middle class that has been left behind, and the pressing need to provide support to Medicare and Social Security, selling these bonds to the Federal Reserve is a gamble well worth taking. I would recommend beginning with this $2 trillion program, because the sum is large enough to postpone our entitlement crisis several years, but I wouldn’t attempt to fund all of the $17 trillion shortfall today as that would raise the risk of causing excess inflation, undermining the purpose of the program. Rather, it is best to take one step likely to succeed today, and then, 5-10 years down the road, the exercise can always be repeated if it proves as successful as I anticipate.

While virtually all Americans agree it is critical to preserve these programs as best as possible, some may question the wisdom of perpetuating them in their current form, and to them I would highlight some key points. First, we should ask honestly ourselves whether Congressional Democrats and Republicans, who both clearly like to spend money when in power, would actually permit Social Security and Medicare to cut benefits when their trust funds run dry? Or rather, would they either raise taxes or sell more debt to the public to fund the shortfall? It seems clear to me that it is better to try my strategy of issuing perpetual debt than issuing debt that has to be repaid to investors or raising taxes on hard-working Americans.

Some others may argue that it is unwise to take this course of action when there would remain a $15 trillion problem. To them, I would make two points. First, I think it better to solve part of the problem than none of it. Second, I don’t pretend this plan is a be-all, end-all solution. Rather, it is intended to add several years of viability to these programs to ensure they can meet the promises made to those at or near retirement who need certainty. It would be fantastic if this $2 billion Federal Reserve bond were paired with measures like gradually lifting the retirement age by 2 years starting in 2024 and moving future Social Security benefit cost of living adjustments to chained-CPI from headline CPI. These measures combined with the $2 trillion cash infusion would greatly extend the lives of Medicare and Social Security. Like President Reagan in 1986, I believe Republicans should take the lead in solving entitlement problems before the crisis is upon us. However, I would rather issue this zero-coupon bond then permanently raise taxes.

Last, it is critical to emphasize again that while many worry America faces a public debt problem and a deficit problem, it does not face an inflation problem. That is largely because the Federal Reserve has run a structurally hawkish monetary policy that has led to below target inflation and lackluster median wage growth. While the Fed, through its quantitative easing program, has been happy to buy bonds to push up asset prices and make the rich richer, it has consistently acted to raise rates and slow the economy as it senses that upward wage pressures are increasing.As such, the one risk my policy increases, inflation (albeit as highlighted above, I emphasize my skepticism inflation would materially rise), is one the economy can afford, if only to counteract the years of overly hawkish Fed policy that have left the middle class behind. Moreover, given the putable nature of my bonds, any period of higher inflation would be short-lived as the Fed puts the bonds back to the Treasury and takes dollars out of circulation. All told, these risks stack up attractively versus the potential of putting $2 trillion into entitlements without issuing debt that has to be repaid or raising taxes.

Donald Trump was elected President because he promised to bring new thinking to our politics, and given the size of their problems, new and innovative thinking is needed to secure Social Security and Medicare. Issuing $2 trillion in zero coupon, putable, perpetual bonds to the Federal Reserve would greatly enhance these programs’ viability at no cost to taxpayers. In fact, by pushing down treasury bonds’ interest rates, taxpayers would save money in coming years.

Let’s act now to protect the retirements of America’s forgotten men and women.